Financial Tips for Seniors

You may have seen a financial programme on TV hosted by Martin Lewis.

His website can be hard work to navigate – the electronic equivalent of a TK Maxx store at the end of the January Sales!

But his financial advice is well worth the effort of wading through all the visual clutter.

Here is a set of financial tips from his most recent blog, aimed at the over-50s.

1. Never just take your pension company's annuity offer. At retirement, many who've saved cash in a pension convert a large chunk into an annuity – a regular income for life. There are three big need-to-knows...

a) Don't just take your pension firm's offer. A nightmarish 60% do, rather than finding the best rates, eg, losing out on £11k per £100,000 over 25 yrs.

b) A health & eye check could net £1,000s. Always check if you've an undiagnosed condition that'll give an 'enhanced', ie, better rate.

c) You can't change your mind. Most annuities are a one-time purchase, which is why if you're not sure, you should get independent financial advice. So for full help on all these and to get the best buys, get the Money Saving Expert's free Annuity Booklet here.

2. You're entitled to it... As you get older, a host of entitlements become yours.

- Over-60s (62-ish in England) get free bus travel. 60+ Londoners, free Tube & bus travel.

- Over-60s get Free Prescriptions in England, saving £7.85/batch (elsewhere they're free anyway).

- Over-75s bag a Free £146 TV Licence, covering the whole household.

- If anyone in your home was born pre-5 Jan 1952, you're due up to £300 in tax-free winter fuel payments (newbies may need to register). Plus anyone on specific income support/jobseeker's allowance or pension credit gets £25 for every 7 days it's sub-0°C. See Winter Fuel & Cold Weather.

- Over-60s get 1/3 off rail tickets with a Senior Railcard.

3. Over-50s' discounts & freebies: B&Q, Odeon, Specsavers, boilers... Age has its privileges. There's a free over-50s' dining card for meal deals at 100+ pubs 'n' carveries. Over-60s get 25% off Specsavers, 10% off B&Q, cheap cinema tiickets & more. See Over-50s' Discounts.

In fact, Martin's tip is (this works better for pensioners): if they offer a student discount, try asking for a pensioner one too. They can only say no!

Plus many pensioners on lower incomes are entitled to Free Boilers and Insulation, sometimes worth £1,000s.

4. Over-50s' cheap car insurance. Older drivers can find it tough to access cheap cover – Martin has compiled a list of Over-50s' Cheap Car Insurance tips. A massive wedge can be saved.

5. Pension Credit. Are you in the 1million missing out on up to £35/week pension credit? The full state single pension's £110/week, yet if your total income is under £145/week or even if you've some savings, you may be entitled to a top-up.

See Pension Credit info for more and the Benefits Check-Up tool; or call 0845 60 60 265 to talk to the Pension Service helpline and find out.

6. Have the "Difficult Conversations" about your Will and what happens if you lose your faculties ahead of your demise. Hopefully you'll live healthy and happily until you're 183. But in case problems arise, it's best to deal and communicate sooner and openly with your family.

a) 1 in 3 over-65s develop dementia. Unless you've a Power of Attorney which allows loved ones to take over your affairs, they need to apply in court, which can be hard and costly. Yet you can sort a PofA, just in case, now, without losing control. See Power of Attorney for help.

b) It's Over 55s' Free Wills Month. Make sure assets go where you want.

c) Discuss your preferences – see Martin's Death Happens – Plan For It guide.

d) Compile a financial factsheet with info loved ones can access (but no security info) on all the products you have, whether cards, breakdown, mobile, insurance or investments, so you're not the sole source of info.

e) Do an Inheritance Tax Plan to make use of allowed exemptions.

For more tips and additional financial advice for the over-50s, click here.

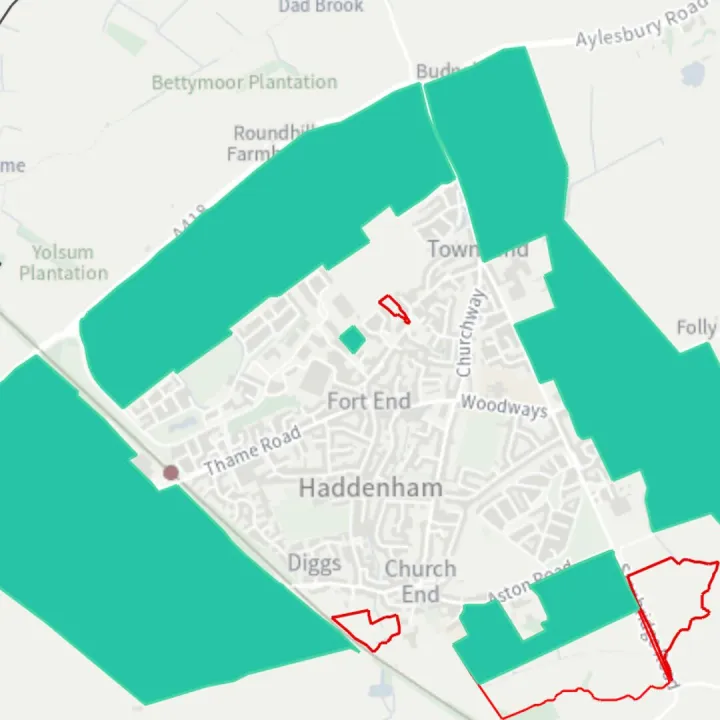

For more general advice and support services offered specifically by Aylesbury Vale District Council to folk in the over-50s age range, please see here.